Earn-Out | Verb of an author, to earn royalties only after the book has exceeded in sales the amount paid as an advance by the publisher prior to publishing. An earnout, formally called a contingent consideration, is a mechanism used in m&a whereby, in addition to an upfront payment, future payments are promised to the seller upon the achievement of specific milestones (i.e. This could extend for several years. An earnout is a payment arrangement under which the shareholders of a target company are paid an additional amount if the company can achieve specific performance targets after an acquisition has been completed. Examples of measurements typically found in earn out payment formulas include:

The basketball star was paid a fortune. If the acquirer keeps a respectful distance and seems to be giving you autonomy, this is a good sign. For example, a company may acquire another for $75 million, with an additional $10 million in cash and/or stock if the acquired company's earnings outperform expectations by a certain percentage. An earnout is a contractual provision stating that the seller of a business is to obtain future compensation if the business achieves certain financial goals. Considerations before agreeing to an earn out.

Setting realistic expectations when there is a gap between an owner and a potential acquirer in the perceived value of a business, it is usually caused by the expected. An earnout is a contractual provision stating that the seller of a business is to obtain future compensation if the business achieves certain financial goals. The maximum stated selling price is determined by assuming that all of the contingencies will be met and that payments will. The differing expectations of a. An earnout is a payment arrangement under which the shareholders of a target company are paid an additional amount if the company can achieve specific performance targets after an acquisition has been completed. If the acquirer keeps a respectful distance and seems to be giving you autonomy, this is a good sign. Verb of an author, to earn royalties only after the book has exceeded in sales the amount paid as an advance by the publisher prior to publishing. Examples of measurements typically found in earn out payment formulas include: Learn how mergers and acquisitions and deals are completed. Generally, these financial goals are stated as gross sales percentage or earnings. In an acquisition, an additional payment made to the acquired company 's former owner (s) in the event that certain earnings are met. These discrepancies are usually a result of differences between expectations in future growth and performance. For example, a company may acquire another for $75 million, with an additional $10 million in cash and/or stock if the acquired company's earnings outperform expectations by a certain percentage.

Earnout is a financial arrangement made between seller and acquirer wherein the seller will receive additional compensation if the business under consideration achieves specified financial goals. These discrepancies are usually a result of differences between expectations in future growth and performance. For example, a company may acquire another for $75 million, with an additional $10 million in cash and/or stock if the acquired company's earnings outperform expectations by a certain percentage. The target amount, performance indicators, and deadlines are determined jointly by the buyer and the seller. Verb to exceed in profits the amount paid in an initial investment.

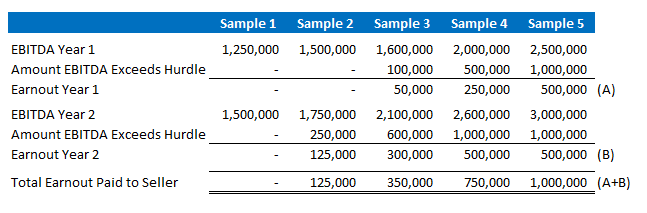

The target amount, performance indicators, and deadlines are determined jointly by the buyer and the seller. Businesses, industries and economies are complex, full of variables and difficult to predict. Some of the more obvious criteria that will need to be examined Setting realistic expectations when there is a gap between an owner and a potential acquirer in the perceived value of a business, it is usually caused by the expected. If you think an acquirer actually expects. An earnout, formally called a contingent consideration, is a mechanism used in m&a whereby, in addition to an upfront payment, future payments are promised to the seller upon the achievement of specific milestones (i.e. For example, a company may acquire another for $75 million, with an additional $10 million in cash and/or stock if the acquired company's earnings outperform expectations by a certain percentage. It is used to bridge the gap between what an acquirer is willing to pay and what the seller wants to earn. What is an earn out payment formula? If the acquirer keeps a respectful distance and seems to be giving you autonomy, this is a good sign. Examples of measurements typically found in earn out payment formulas include: The basketball star was paid a fortune. One possible solution to this dilemma is earnouts, which help bridge the gap between an optimistic seller and a skeptical buyer.

Earn out payments may be linked to almost anything to which a willing seller and buyer can agree. Gross revenue, gross profit margin, ebitda, adjusted ebitda, ebit, gross revenue per full time employee, employee retention rates, gross revenue growth rates, and more. An earnout, formally called a contingent consideration, is a mechanism used in m&a whereby, in addition to an upfront payment, future payments are promised to the seller upon the achievement of specific milestones (i.e. Earnouts are often employed when the buyer(s) and seller(s. The basketball star was paid a fortune.

Businesses, industries and economies are complex, full of variables and difficult to predict. An earnout is a contractual provision stating that the seller of a business is to obtain future compensation if the business achieves certain financial goals. Verb to exceed in profits the amount paid in an initial investment. These discrepancies are usually a result of differences between expectations in future growth and performance. An earnout is a payment arrangement under which the shareholders of a target company are paid an additional amount if the company can achieve specific performance targets after an acquisition has been completed. For example, a company may acquire another for $75 million, with an additional $10 million in cash and/or stock if the acquired company's earnings outperform expectations by a certain percentage. Mergers acquisitions m&a process this guide takes you through all the steps in the m&a process. Examples of measurements typically found in earn out payment formulas include: If you think an acquirer actually expects. Considerations before agreeing to an earn out. For example, a company may acquire another for $75 million, with an additional $10 million in cash and/or stock if the acquired company's earnings outperform expectations by a certain percentage. Gross revenue, gross profit margin, ebitda, adjusted ebitda, ebit, gross revenue per full time employee, employee retention rates, gross revenue growth rates, and more. The differing expectations of a.

Earn-Out: If the acquirer keeps a respectful distance and seems to be giving you autonomy, this is a good sign.

Post a Comment